Content

Government accounting uses modified accrual accounting, a more restrictive form of accrual accounting. It records revenues and expenses only when they’re expected to be received or paid in the near future. They also promote transparency so that readers such as public officials and taxpayers can access and understand relevant information. Government Accounting, on the other hand, refers to the Governments (both States and Central).

- Governments and public companies abide by these accounting principles to ensure all documents present consistent, accurate, and clear reports.

- For example, in June 2022, GASB issued an Invitation to Comment for public feedback which regards providing users of government financial statements with critical information about vulnerabilities for risk and disclosure for state and local governments.

- GASB members are qualified in governmental accounting and finance and are concerned with public interests in the nation’s accounting and financial reporting.

- They collect information by speaking to those most affected by the problem; usually a consortium of companies, governments, auditors, and/or investors.

- On the recommendation of the American Institute of CPAs (AICPA), the FASB was formed as an independent board in 1973 to take over GAAP determinations and updates.

- At the end, we will go through some common FAQs and detail the potential benefit of utilizing lease accounting in the wake of all the recent changes in GASB accounting standards.

- The funding mechanism was established by Section 978(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act).

Since its introduction in 1992, COSO has been the most universally accepted framework for evaluating internal controls. When the SEC and PCAOB were implementing the Sarbanes-Oxley Act, it was the understood framework for compliance with that law. In 2013, COSO got its first major overhaul since its release two decades earlier; and it is a major change of character. However, the addition of Principles and Points of Focus dramatically change the practical implementation and application of COSO in all organizations; not just SEC filers. This course is designed to help in the understanding of the new elements and the overhaul in the use of COSO, and it goes far beyond SOX compliance.

THE IMPORTANCE OF GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP)

As with most of the entities involved in creating GAAP in the United States, it is a private, non-governmental organization. The statements and reports listed above follow national standards of financial reporting. They should not be confused with legal reporting requirements, which are prescribed by the State Auditor’s Office for all local governments in Washington State.

Everything you need to know about the Governmental Accounting Standards Board (GASB) and the latest GASB standards. The curriculum combines preparation for the CPA exam with the technical skills that employers seek, with the convenience of coursework that’s fully online. Learn more about how the University of Nevada, Reno can help you pursue your professional goals in accounting.

Government accounting principles

The GASB gets funding from publishing revenue, investment income, and accounting support fees paid by dealers who trade in municipal bonds. Expenditures should be classified by fund, function (or program), organization unit, activity, character, and principal classes of objects. Transfers should be reported in the accounting period in which the interfund receivable and payable arise. Elected officials should be educated to the fact that accountability may be achieved effectively and efficiently by judicious use of department, program and other available account coding or cautious use of managerial (internal) funds.

The consistency of GAAP compliance also allows companies to more easily evaluate strategic business options. Thus, GASB is the acting body that enforces and updates GAAP, which are all different accounting principles that are constantly changing. Each one has a name that starts with “GASB” followed by a number indicating which accounting principle it is.

What is GASB? The Complete Guide

Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. It goes by the name of GASB 96, and it establishes a definition of an SBITA, or a subscription-based information technology agreement, and puts rules in place for their constituents to abide by to make sure these lease-like agreements are standardized. These criteria should be applied in the context of the activity’s principal revenue source.

- This approach to accounting is used by all types of government entities, including federal, state, county, municipal, and special-purpose entities.

- The latter covers the newly-set lease documentation and accounting standards for Subscription-Based Information Technology Arrangements, or SBITAs.

- The statements and reports listed above follow national standards of financial reporting.

- Government accounting ensures that financial management follows applicable laws.

- Although setting standards for State and local accounting is important, compliance with the standards is also important.

- Expenditures should be recognized in the accounting period in which the fund liability is incurred, if measurable, except for unmatured interest on general long-term liabilities, which should be recognized when due.

- The GASB is subject to oversight by the Financial Accounting Foundation (FAF) Board of Trustees, which selects its board members, and the FASB, both of which it funds.

- Check out our educational information to stay updated with the latest news on GASB statements and other accounting organizations and standards.

Some types of funds use a different basis of accounting and measurement focus. To clarify the difference between these concepts, the basis of accounting governs when transactions will be recorded, while the measurement focus governs what transactions will be recorded. The Great Depression in 1929, a financial catastrophe that caused years of hardship for millions of Americans, was primarily attributed to faulty and manipulative reporting practices among businesses. In response, the federal government, along with professional accounting groups, set out to create standards for the ethical and accurate reporting of financial information.

Open Required Supplementary Information (RSI) sub menu

For example, banks operate using different accounting and financial reporting methods than those used by retail businesses. GAAP compliance makes the financial reporting process transparent and standardizes assumptions, terminology, definitions, and methods. External parties can easily compare financial statements issued by GAAP-compliant entities and safely assume consistency, which allows for quick and accurate cross-company comparisons. In October 1990, three officials responsible for federal financial reporting established the Federal Accounting Standards Advisory Board (FASAB or ‘the Board’) as a federal advisory committee. The officials were the Secretary of the Treasury, the Director of the Office of Management and Budget, and the Comptroller General of the United States. They created FASAB to develop accounting standards and principles for the United States Government.

Why is IFRS referred to as common accounting rules?

IFRS specify in detail how companies must maintain their records and report their expenses and income. They were established to create a common accounting language that could be understood globally by investors, auditors, government regulators, and other interested parties.

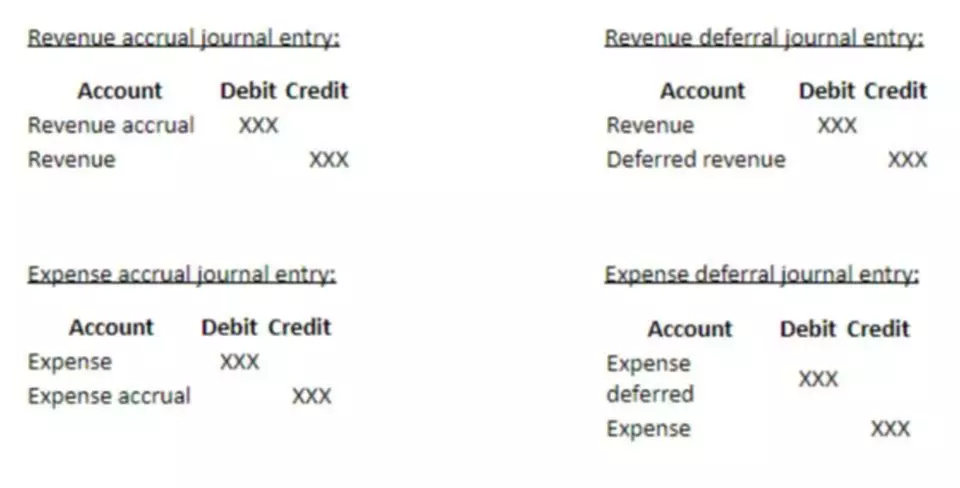

The focus of governmental and proprietary fund financial statements is on major funds. The reporting entity’s fund financial statements should present the primary government’s (including its blended component units, which are, in substance, part of the primary government) major funds individually and nonmajor funds in the aggregate. Funds and component units that are fiduciary in nature should be reported only in the statements of fiduciary net position and changes in fiduciary net position. The basis of accounting refers to when specific activities and transactions will be identified in the accounting records and included in the financial statements. This can either be done on an accrual basis, where revenues and expenses are recorded at the time they are incurred, or on a modified accrual basis, which means when revenues are reasonably able to be estimated. A modified accrual basis is typically used by agencies receiving funding as tax revenue since the taxes being collected are easily estimated, because the bills are generated by the government entity.

Lease Accounting Blog

Under the modified basis of accounting, revenue and governmental fund resources (such as the proceeds from a debt issuance) are recognized when they become susceptible to accrual. This means that these items are not only available to finance the expenditures of the period, but are also measurable. The “available” concept means that the revenue and other fund resources are collectible within the current period or sufficiently soon thereafter to be available to pay for the current period’s liabilities. The “measurable” concept allows a government to not know the exact amount of revenue in order to accrue it. A clear distinction should be made between fund long-term liabilities and general long-term liabilities.

The GASB is also advised by the Governmental Accounting Standards Advisory Council (GASAC), an organization that was established by the FAF’s Board of Trustees to advise the GASB on its agenda, priorities and procedural matters. Importantly, the GASAC doesn’t vote on board matters or make decisions about standards. Instead, it provides the GASB with contextual information about the diverse individuals that GASB may impact. This empowers the GASB to understand diverse views and make informed decisions accordingly. The GASB is subject to oversight by the Financial Accounting Foundation (FAF) Board of Trustees, which selects its board members, and the FASB, both of which it funds.

Open Liabilities sub menu

The Governmental Accounting Standards Board (GASB) sets financial accounting and reporting standards, known as Generally Accepted Accounting Principles (GAAP), for state and local government. The Financial Accounting Standards Board (FASB) sets standards for public and private companies and non-profit organizations. Both standard-setting bodies receive oversight and administration from the Financial Accounting Foundation. The reporting entity is the primary governmental accounting government (including its blended component units) and all discretely presented component units. Proprietary fund statements of net position and revenues, expenses, and changes in fund net position should be presented using the economic resources measurement focus and the accrual basis of accounting. These include (a) investment trust funds, (b) pension (and other employee benefit) trust funds, (c) private-purpose trust funds, and (d) custodial funds.